SBA Coronavirus Funding Options

Our nation’s small businesses are facing an unprecedented economic disruption due to the Coronavirus (COVID-19) outbreak. On Friday, March 27, 2020, the President signed into law the CARES Act, which contains $376 billion in relief for American workers and small businesses.

Funding Options

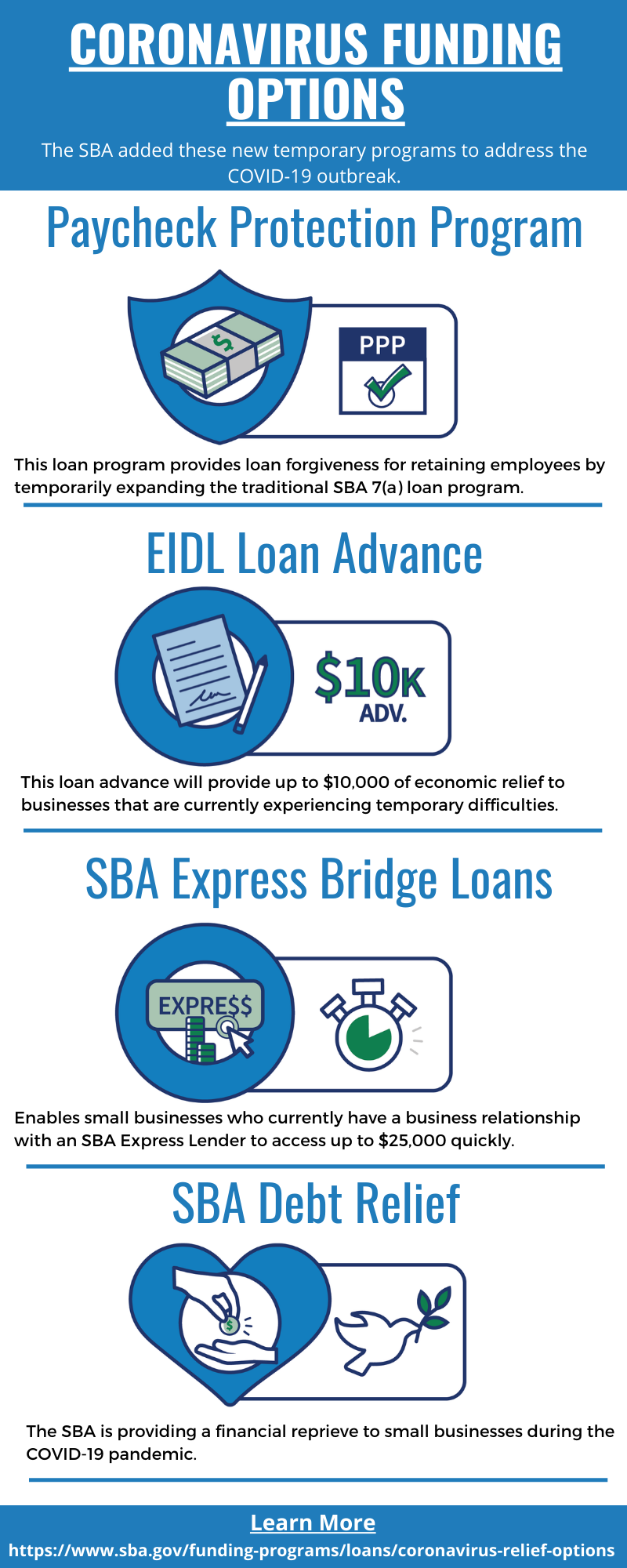

In addition to traditional SBA funding programs, the CARES Act established several new temporary programs to address the COVID-19 outbreak.

- Paycheck Protection Program

- This loan program provides loan forgiveness for retaining employees by temporarily expanding the traditional SBA 7(a) loan program. Learn more

-

-

This loan advance will provide up to $10,000 of economic relief to businesses that are currently experiencing temporary difficulties. Learn more

-

- SBA Express Bridge Loans

- Enables small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000 quickly. Learn more

- SBA Debt Relief

- The SBA is providing a financial reprieve to small businesses during the COVID-19 pandemic. Learn more