Stimulus Check Breakdown

The $2 trillion relief bill will send money directly to Americans, greatly expand unemployment coverage and make a number of other changes. (The information provided below is from The New York Times article F.A.Q. on Stimulus Checks, Unemployment and the Coronavirus Plan by Tara Siegel Bernard and )

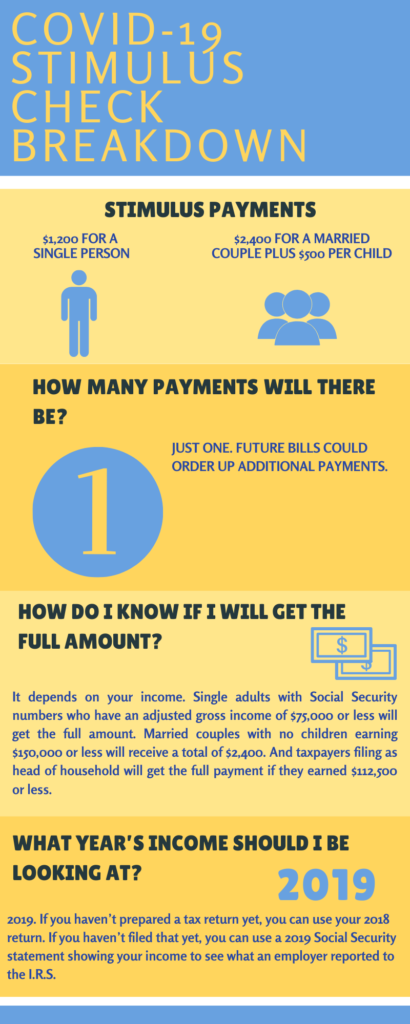

Stimulus Payments

Stimulus Payments

How much will the payments be?

Most adults will get $1,200, although some would get less. For every qualifying child age 16 or under, the payment will be an additional $500.

How many payments will there be?

Just one. Future bills could order up additional payments, though.

How do I know if I will get the full amount?

It depends on your income. Single adults with Social Security numbers who have an adjusted gross income of $75,000 or less will get the full amount. Married couples with no children earning $150,000 or less will receive a total of $2,400. And taxpayers filing as head of household will get the full payment if they earned $112,500 or less.

Above those income figures, the payment decreases until it stops altogether for single people earning $99,000 or married people who have no children and earn $198,000. According to the Senate Finance Committee, a family with two children will no longer be eligible for any payments if its income surpassed $218,000.

You can’t get a payment if someone claims you as a dependent, even if you’re an adult. In any given family and in most instances, everyone must have a valid Social Security number in order to be eligible. There is an exception for members of the military

You can find your adjusted gross income on Line 8b of the 2019 1040 federal tax return.

What year’s income should I be looking at?

2019. If you haven’t prepared a tax return yet, you can use your 2018 return. If you haven’t filed that yet, you can use a 2019 Social Security statement showing your income to see what an employer reported to the I.R.S.

Will I have to apply to receive a payment?

No. If the Internal Revenue Service already has your bank account information from your 2019 or 2018 returns, it will transfer the money to you via direct deposit based on the recent income-tax figures it already has.